Hey friends! Today, we’re going to take a full look at South Korea’s economy — from the start of 2025 up to October — and also glance back at 2024 to see what’s really changed.

Some questions you might be wondering:

- Why is the fiscal deficit still climbing so high?

- Even though tax revenue has grown, why can’t the government keep spending under control?

- And what’s happening with Korea’s current account surplus — is it still stable or starting to shrink?

This article will clarify the entire picture — tax revenues, government expenditures, deficits, and the current account — in an easy-to-understand way, such that even if the numbers initially sound confusing, you will learn what it all actually means in everyday life.

So grab your coffee, get comfortable, and discover the journey of the South Korea Fiscal Deficit between 2024 and October 2025 — the whole story simplified!

2024: Presenting the Images

- For South Korea, 2024 was a complicated and intriguing year.

- Fiscal Pressures

- The managed fiscal deficit (excluding social security funds) reached ₩104.8 trillion, exceeding the budgeted amount of ₩91.6 trillion.

- The consolidated fiscal deficit (which includes social security) was ₩43.5 trillion, or around 1.7% of GDP.

In simple words — the government spent more than it earned, and that caused some worry.

Tax revenue challenges

The OECD reported that business tax revenue fell in 2024, which widened the deficit. Policies were designed to keep the deficit under control, but revenue shortfalls made it tricky.

Trade and current account

On the bright side, South Korea’s trade side was strong:

- The country recorded a $99.04 billion current account surplus, about 5.3% of GDP.

- This was mainly the result of exports of semiconductors and cheaper import prices.

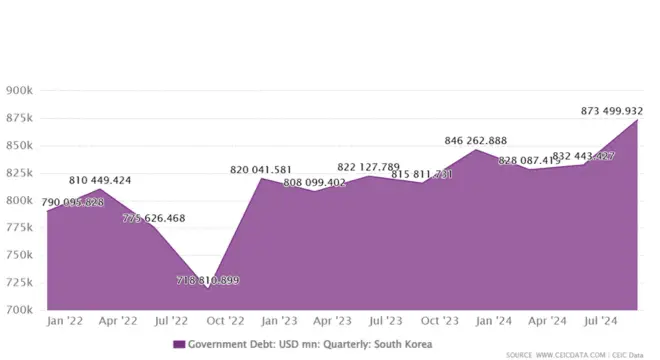

Meanwhile, the ratio of debt to GDP was around 52.9%, though a small increase could be expected in 2025.

Bottom line: 2024 was a mix of pressures to revenue on one side, but strong performance in trade lessened that impact. Government spending was high, but exports and the current account surplus helped to keep the economy in check.

2025 (Jan – Oct): Tax Revenue Looking Better

Now, for 2025 – we begin to see some positive signs.

Jan – Aug 2025 Takeaways

- Tax revenue came in at ₩260.8 trillion, or ₩28.6 trillion greater than the corresponding time frame in 2024.

- Growth in tax revenues primarily came from corporate taxes (+ ₩17.8 trillion), and income taxes (+ ₩9.6 trillion).

However, not everything is rosy:

- VAT (Value Added Tax) came in slightly behind with collections ~₩1.2 trillion less than the previous year, suggesting a small decline in consumer spending.

Putting tax and non-tax revenue together, the total:

- ₩431 trillion in revenue, which is ₩35 trillion greater than the same time last year.

In short: businesses and people paid more in taxes – or the government was better at collecting taxes.The small drop in VAT suggests people may be spending a little less, which could slightly slow overall demand.

2025: Spending & Deficit — Still a Heavy Load

Even though revenue is up, spending is rising even faster.

- Total expenditure (Jan–Aug 2025): ₩485.4 trillion (₩38.4 trillion higher than last year).

- This led to a managed fiscal deficit of ₩88.3 trillion.

Budget projections:

- 2025 consolidated fiscal deficit is expected to be around 1.0% of GDP (better than 2024’s 1.7%).

- Managed fiscal deficit is about 2.9% of GDP, compared to 3.6% in 2024.

So while things are improving, the numbers are still pretty heavy.

To support the economy, the parliament also approved a ₩31.8 trillion supplementary budget, aimed at helping households and small businesses, especially as exports slowed.

Extra spending gives short-term relief, but in the long run, it also adds pressure on debt and deficit.

Current Account & Trade — 2025

The trade side continues to support the economy:

- Current account surplus (August 2025): $9.15 billion

- Goods account surplus: ~$9.4 billion

- Exports fell slightly by 1.8%, imports dropped 7.3%

- Services sector had a deficit of ~$2.12 billion (mainly travel & business services), but primary income surplus ~$2.07 billion helped stabilize the balance

Comparing with 2024:

- Current account surplus was $99.04 billion (5.3% of GDP).

Bottom line: trade is still the “engine” of South Korea’s economy. Semiconductor and electronics exports kept inflows steady. But if global demand weakens, the surplus could start feeling the pressure.

Quick Comparison — 2024 vs 2025 (till Oct)

| Indicator | 2024 (Annual) | 2025 (Jan–Aug / Trends) |

| Managed fiscal deficit | ₩104.8 trillion | ₩88.3 trillion |

| Consolidated fiscal deficit | ₩43.5 trillion (~1.7% GDP) | ~1.0% GDP target |

| Current account surplus | $99.04 billion (5.3% GDP) | $9.15 billion (Aug) |

| Revenue trend | Pressure in business tax | Strong growth (corporate + income) |

| Expenditure trend | Rising, overshoot | Extra budget, higher spending |

| Debt-to-GDP | 52.9% | Slight projected rise |

What This Really Means

1. Fiscal Sustainability Issue Revenue is improving, but it needs to be managed; we cannot continue spending as before and borrowing money. Because, we are going to increase our debt and face a dual burden.

2. Borrowing Pressures The government can borrow the money, or issue bonds or other debt instruments when faced with deficits, which could lead to more borrowing or an increased debt to GDP ratio.

3. Currency & Investor Sentiment The size of the current account surplus usually stabilizes the KRW and allows further foreign capital inflows would stabilize the KRW against weak exports where it may be a downward pressure on the KRW.

4. Policy Balancing Act The government faces a very different, yet challenging decision: Does the government stimulate the economy, or does it maintain fiscal discipline? The supplementary 2025 budget shows how this is a balancing act.

5. Future Growth Engines The drivers of future growth are exports (semiconductors/electronics) and overseas income. Weak global demand would mean a challenged trade side.

6. Inflation & Interest Rates Higher levels of deficits and spending could potentially lead to the monetary authority raising interest rates or tightening the money supply to rein in inflation has the potential to act as drag on growth.

Conclusion

So far in 2025, the story is mixed:

- Tax revenue is performing well

- Spending is rising even faster, leading to a ₩88.3 trillion deficit

The current account surplus is helping keep things stable, but global trade uncertainties and high spending remain risks.

2024 showed that strong trade can cushion the blow of deficits and revenue pressures.

2025’s big challenge is balance:

- Keep revenue growth steady

- Maintain spending discipline

- Keep trade momentum alive

If 2024 was about “managing damage,” then 2025 is about “building stability.”