Have you seen the headlines lately?

“South Korea’s inflation is rising again in 2025!”

But wait — wasn’t inflation supposed to be under control by now?

So, what suddenly went wrong?

Did the government make a policy mistake?

Or is something bigger happening behind the scenes?

Let’s find out together.

Because when we talk about South Korea inflation 2025, we’re not just talking about prices and percentages — we’re talking about how one of Asia’s most powerful economies is walking a tightrope between growth and stability.

From currency struggles to rising fuel costs and a heating housing market — every piece of this puzzle tells us something about the real challenges South Korea is facing right now.

The Calm Before the Storm

A few months ago, things looked pretty stable in South Korea.

Prices were cooling down, the economy was slowly improving, and the Bank of Korea (BOK) had paused its interest rate cuts after easing them last year.

Everything seemed under control.

Until October happened.

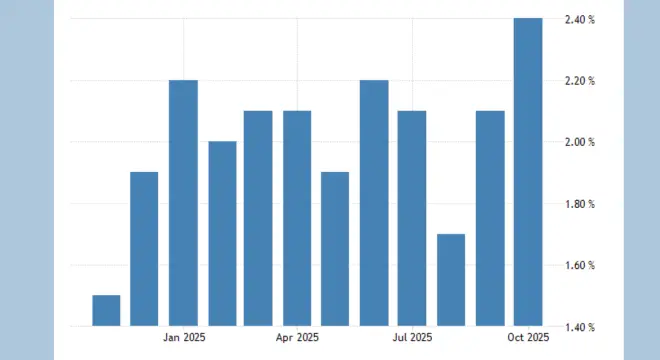

The latest data from the Ministry of Data and Statistics showed that consumer prices in October rose by 2.4% from a year earlier — up from 2.1% in September, and even higher than economists’ forecast of 2.2%.

At first glance, 2.4% might not look like a big deal.

But for central bankers, that’s enough to change everything.

Core Inflation Creeps Higher

Now here’s the real twist — it’s not just one-time price increases.

Core inflation, which excludes volatile items like food and energy, also climbed to 2.2% from 2.0%.

That’s a clear sign that price pressure is spreading across the economy — from groceries to rent to services.

But what’s behind this sudden jump?

Let’s break it down.

The Weak Won: When Currency Loses Power

The first big reason: South Korea’s currency — the won — got weaker.

In October, it fell nearly 1.9% against the US dollar, its weakest level since March.

Now, here’s why that matters:

When the won weakens, everything that South Korea imports — oil, gas, food, cars — becomes more expensive.

Even if global prices don’t change, importing those goods costs more in local currency.

So, the weaker won quietly pushes up prices across the board.

It’s similar to a hidden tax that affects everyone from businesses to families shopping for groceries.

Fuel Taxes: How hard is the decision of the government?

Another significant aspect was the government’s choice to reduce fuel tax subsidies partially in October.

Those subsidies had previously lowered fuel prices.

But when they were reduced, gasoline prices instantly shot up.

Transportation costs jumped by 3.4% compared to a year ago — and that doesn’t just affect drivers.

It trickles into delivery prices, logistics, and even the cost of your next online order.

Fuel prices are like a domino — when they rise, almost everything else follows.

The Festival Effect: Spending and Shortages

And then came the Chuseok holiday season, one of the most celebrated times in South Korea.

Families travel, shop, and celebrate — meaning food, gifts, and transportation demand all go up at once.

As a result, food and non-alcoholic beverage prices rose 3.5% year-on-year.

Economists call this seasonal inflation — it doesn’t last forever, but it adds a short-term burst of price pressure.

Still, for ordinary people trying to manage expenses, it’s another hit to the wallet.

Real Estate on Fire

While everyday prices were climbing, another bubble was quietly expanding — housing.

In Seoul, apartment prices have been rising for 39 consecutive weeks as of late October.

Yes, you read that right — 39 straight weeks of gains!

Even as the broader economy slowed, real estate just kept going up.

Low interest rates and limited supply have turned housing into one of the hottest assets in the country.

But that’s exactly what makes policymakers nervous — what if this turns into an asset bubble?

If housing prices suddenly crash, it could shake the entire financial system.

The Bank of Korea’s Big Dilemma

Now imagine you’re sitting in the Bank of Korea’s policy meeting.

What would you do?

Option one: Cut interest rates to help the economy and exports.

Option two: Hold rates steady to control inflation and prevent housing bubbles.

Tough choice, right?

For now, the central bank has chosen to pause rate cuts for three straight meetings — watching carefully as inflation and housing prices move.

But some experts, like economists at Barclays Bank, believe that the BOK might still go ahead with a rate cut in November.

Their logic?

Much of the inflation rise might be temporary — caused by seasonal spending, fuel adjustments, and currency swings — not by deep-rooted inflation pressure.

🇺🇸 The Tariff Trouble: When the US Steps In

And just when things couldn’t get more complicated, the United States introduced new tariffs on South Korean goods — a hefty 15% on exports.

That’s a serious problem for a country that relies heavily on trade.

The BOK estimates these tariffs could reduce Korea’s GDP growth by 0.45 percentage points this year, and 0.6 percentage points in 2026.

So here’s the dilemma again:

If the bank keeps rates high, growth will suffer.

But if it cuts rates, inflation might rise further.

Either way, the Bank of Korea is walking on a tightrope.

A Quick Snapshot

Let’s quickly recap what’s happening

| Factor | What Happened | Impact |

| Inflation | Rose to 2.4% | Stronger price pressure |

| Core Inflation | Increased to 2.2% | Broader inflation signs |

| Won Currency | Fell 1.9% vs USD | Higher import prices |

| Fuel Tax Rollback | Partial removal | Gasoline prices up |

| Food Prices | Up 3.5% | Driven by holiday demand |

| Real Estate | 39 weeks of gains | Risk of asset bubble |

| US Tariffs | 15% on exports | Slower growth risk |

What Happens Next?

So what should we expect in the months ahead?

Will the Bank of Korea stand firm, or will it give in to pressure and start cutting rates again?

Can the won recover its strength against the dollar?

And will Seoul’s housing boom finally cool down — or are we heading toward something bigger?

These are the questions that investors, economists, and ordinary Koreans are all asking right now.

The Bottom Line

South Korea’s economy is facing one of its most complicated moments in years.

Prices are rising, the currency is weak, housing is overheated, and external shocks like US tariffs are threatening exports.

The Bank of Korea must now make a careful choice — between controlling inflation and supporting growth.

A single wrong move could either slow the economy too much or allow prices to spiral higher.

But one thing is certain: whatever happens next will shape South Korea’s financial story for years to come.

Because sometimes, a small change — like a 0.3% rise in inflation — can set off a chain reaction across an entire nation’s economy.